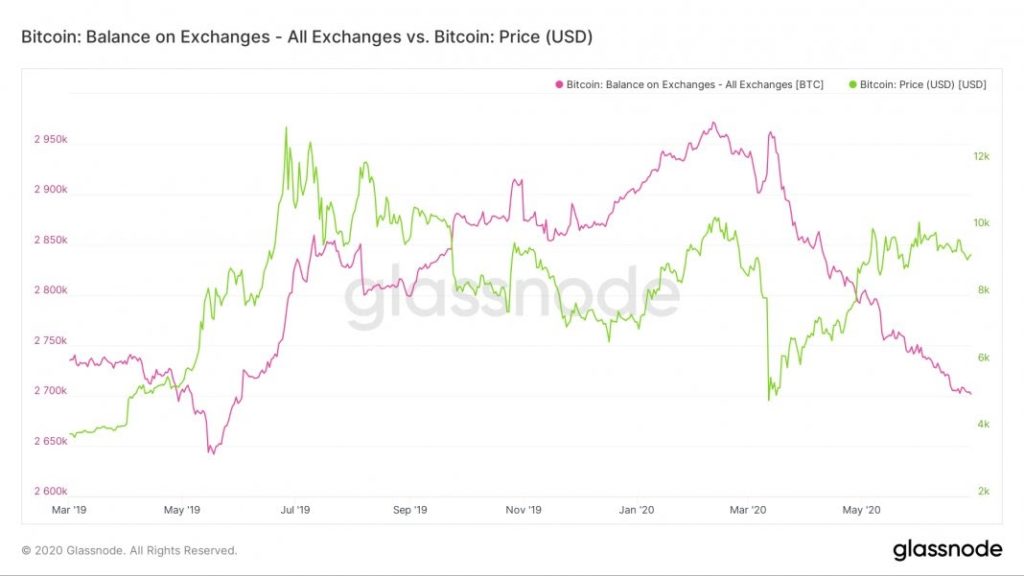

According to this week’s data from Glassnode, the amount of Bitcoin kept on crypto exchanges was at its lowest point from several months. Since March 12th and 13th, after the most famous ‘Black Thursday’, when the market crash took place, the total number of Bitcoins has been steadily falling. Indeed the data of Glassnode revealed that the amount of BTC stored in crypto exchanges has dropped from 29,50,000 BTC to 27,00,000 BTC, which is around $2.85 billion less.

The reason behind the fall?

The drop in the amount of stored Bitcoin on crypto exchanges could end up with declining users’ trust, regarding how to keep their funds safe. However, there have been several incidents this year that affected several crypto exchanges and the funds of users in the exchanges like, Big hacking incident of KuCoin, and several other exchanges like, Eterbase, Cashaa, Balancer and many were hacked.

Although there were two significant incidents, last week’s arrest of Star Xu, the founder of OKEx, and charges upon co-founders of BitMEX, are persuading traders to get their funds out of crypto exchanges. However, in both these cases, no hackers were involved. However, BitMEX stayed unaffected, whereas OKEx had to break off all its operations.

Lack of transparency promoting users distrust

According to John Jefferies, Chief financial analyst at CipherTrace, disappointing transparency and jurisdiction shopping could jointly bring an increment to the trader’s risk, that is beyond the volatility of the stored assets. This jurisdiction shopping is promoting distrust highly, like, OKEx comes under the jurisdiction of a well-regulated jurisdiction in Malta. However, according to their terms, non-Maltese and non-Italian consumers are served through a Seychelles subsidiary, namely Aux Cayes, which offers risky financial products, like, margin lending, spot services, P2P matching and other derivative works linked to indices. In the crypto space, Jurisdiction shopping is a matter of great interest.

BitMEX and OKEx incidents are favourable for crypto space

Both incidents that happened with OKEx and BitMEX will show up a positive effect in the cryptosphere. However, Juan Aja, co-founder of Shyft Network, as long as users funds could be hacked or seized, the concern over the safety of exchanges is going to stay reasonable. Meanwhile, several exchanges have learned about the improvement of protection and security, and de-risk wallets by balancing hot and cold wallets. Indeed these improvements are yet not proactive, causing concerns among the space.

This holding period may come to an end after the traders will find a sharp upward movement and will desire to liquidate some of their tokens, till then the Bitcoin reserves will continue to stay low.