- BSV price is making a bullish movement.

- BSV is trading at $39.8 with an upsurge of 8.75% in the intraday session.

- The token is down by 91.77% from its all-time high.

The BSV token has recorded an ROI of 26.74% in the last month. It has marked a yearly high of $56. In the beginning of this month, the price crossed above the 50-day EMA and became bullish.

The token had marked an all-time high on 16th April 2021, when it was priced at $491.64. The market cap of the token during the high was at $8.26 Billion.

The token is trading with a hike of 200% in the trading volume in the last 24 hours.

It has a current market cap of $770.51 Million. The circulating supply of the token is 19.26 Million BSV, which is 91.74% of the total supply. The 24-hour trading volume of the token is $265.55 Million.

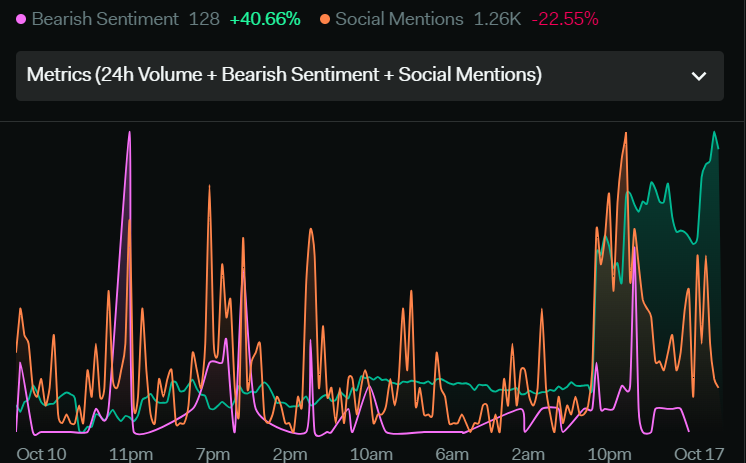

Sentiment Analysis

The total volume of the token has declined by 5.7% in a week. Total social mentions have decreased by 22.55% and the total bearish sentiments have surged by 40.66%. Overall sentiments indicate an upcoming bearish movement in the price as the volume is decreasing and the price is also at the resistance level, due to which bearish sentiments have increased.

Technical Analysis Of BSV ( Daily-1D )

The chart shows that the BSV price is moving along a bullish trendline. The price crossed the 50-day EMA m and gave a great bullish move. After moving upwards, the price faced rejection on the $40 resistance level and fell down to the 50-day EMA. The price again took support from this level and gave a bullish move. Once more, it faced rejection from the same resistance level of $40.

If the price has to move above the resistance level of $40, the bulls have to defeat the bearish investors pushing the price down from the resistance levels. The volume has to be significantly increasing for this to be possible. After breaking the $40 resistance level, the next target will be $44.

The price can come down to the bottom of the trendline and again take support from the trendline and try to break the resistance. The price has to be sustained above the 50–day EMA to continue its bullish trend.

However, If the price falls below the trendline and the 50-day EMA, then it can fall to the $28 to $29.8 support levels. The price may fall further below the support level to fill the liquidity of $25 on 17th August 2023 and then move upwards.

What Indicators Say About BSV Price

Relative Strength Index (RSI)

The RSI line is presently moving at 69.08 points and the SMA 14 is moving at 56.89 points. Both are above the neutral level of 50. The RSI is showing bullishness in the price and soon, the price can enter the overbought region from where it might get bearish and come down.

Moving Average Convergence/Divergence (MACD)

The fast blue line moving average is moving above the red slow line moving average. The histogram is showing an increase in the volumes which is a positive sign for an upward movement in the price.

Bitcoin SV Live Chart

Conclusion

The overall analysis of BSV shows that the price can continue its bullish movement if it breaks above the $40 resistance level. However, If the price starts falling instead, the next support f will be the bottom of the trendline and the support level of $34.6.

Technical Levels

- Support Level: $28 to $29.8 and $34.6

- Resistance Level: $40 and $44

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.