- In just the last seven days, the trading price of LINK crypto has advanced by 24.0%.

- The fear and greed index for Chainlink crypto indicates greed and currently is at 60.

Chainlink is a network of decentralized oracles that link smart contracts to real-world data. LINK is the token that powers the network and rewards the data providers. Chainlink was founded by Nazarov and Ellis in 2017 to enhance the capabilities and use cases of smart contracts.

The derivatives trading volume of the crypto has advanced by 0.51%, resulting in $2.59B. The spot trading volume of the crypto has declined by 15.8% in the last 24 hours.

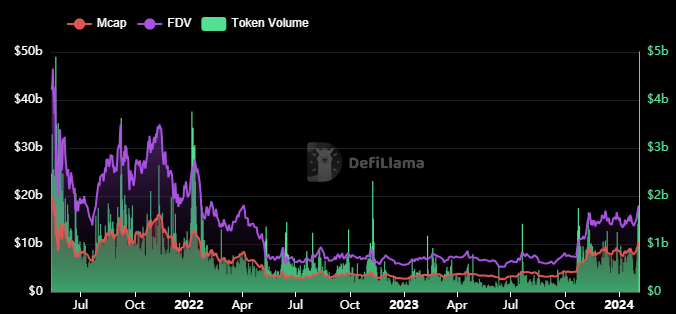

The current market cap value of the Chainlink crypto is $10.352B, which makes it the 11th largest cryptocurrency in the world. Also, the volume/market cap ratio of the crypto is 12.53%.

The open interest of the crypto has witnessed an advance of 1.18% and the long/short ratio of the crypto is 1.0036. It also has witnessed a long liquidation of $1.52M and the short liquidation for the crypto is $1.49M.

The market cap dominance of the LINK crypto is 0.62% and the volatility of the crypto is 4.98%, which is considered medium. Also, the sentiment of the crypto is bullish and the supply inflation of the crypto is high.

Chainlink Crypto Blockchain Data Overview

The Chainlink token liquidity is worth $70.03M and the annualized revenue of the crypto is $1.95M. Also, the staked amount for the crypto is 7.42% of the market cap resulting in $773.28M.

The fully diluted valuation of the crypto is $17.76B and the circulating supply of the crypto is 584.049M LINK, followed by a total supply of 1.0B LINK.

LINK Crypto Technical Analysis

The price of the LINK crypto was trading inside a tight range of consolidation for more than 500 days and broke out above the pattern in October 2023.

After the breakout, the price of the crypto surged by 80% and is still trading at higher levels, following strong bullish momentum followed by bullish price action on the charts.

LINK/USD Chart by TradingView

The LINK crypto price is trading above the crucial EMAs and the 50-day and the 200-day EMAs are trading in a golden cross. This shows an uptrend in the crypto price.

The MACD is also giving a strong buy signal as strong green histogram blocks can be seen on the chart. The signal and the MACD line are also trading in a bullish cross above the zero level.

The RSI has hit the level of 67.68 and is only a few points away from the overbought zone, which indicates a strong bullish momentum in the AVAX crypto price.

Summary

The LINK crypto price has shown strong positive momentum in the last week, breaking out of a long consolidation phase. The technical indicators are bullish and the market sentiment is greedy. The following factors indicate that the price of the crypto might lead to a further higher level in the future.

Disclaimer

This article is for informational purposes only and does not provide any financial, investment, or other advice. The author or any people mentioned in this article are not responsible for any financial loss that may occur from investing in or trading. Please do your research before making any financial decisions.